- December 23, 2024

-

-

Loading

Loading

Early next month, July 9 to be exact, the Sarasota County Commission is expected to conduct a public hearing on whether to change the formula for the allocation of the county’s tourist-tax dollars.

That’s the $15 million-plus a year collected on hotel and motel rooms and seasonal residential rentals — the 5% “bed tax” visitors see at the bottom of their hotel charges.

As you can see in the accompanying table, that 5 cents per $1 is spread among a variety of tourist-related uses.

And as you might guess, some of the recipients of this cash flow want more of it. Others want to take some of it away and allocate it elsewhere. Some have even suggested putting a cap on how much goes to specific uses.

Sarasota County Commissioner Joe Barbetta, for instance, would like the county to adopt an allocation model similar to Nashville’s — earmarking a percentage of the tax collections for capital assets. That could include a variety of things: say, a conference center, aquarium, ballet theater, equestrian center, maybe another stadium (Fort Myers has two!).

One group known as Sarasota Bayfront 20:20 has big ideas for the site of the former Quay and the Van Wezel Performing Arts Hall. You can be sure it’s thinking about this source of cash, too.

And then there’s Virginia Haley, president of Visit Sarasota County, the not-for-profit organization that manages and spends that $5 million listed in the accompanying table. Haley and her organization market Sarasota County around the world to keep those visitors coming to stay in the region’s condos and hotels; fill our restaurants and theaters; and buy stuff.

No surprise, Haley, her board and the members of the Tourist Development Council (the region’s hoteliers) are protective of their 34% of the tourist taxes. The idea of capping the amount it receives mobilized Haley and the hotel industry, and for the past two months they have been on the offense letting commissioners and others know they’re not anxious to share.

Well, they don’t exactly put it that way, in the negative. Their argument is framed more in the affirmative: If you want those tourist-tax dollars to continue to grow, you need to market and advertise. In fact, they’ll tell you Sarasota County should be doing a lot more.

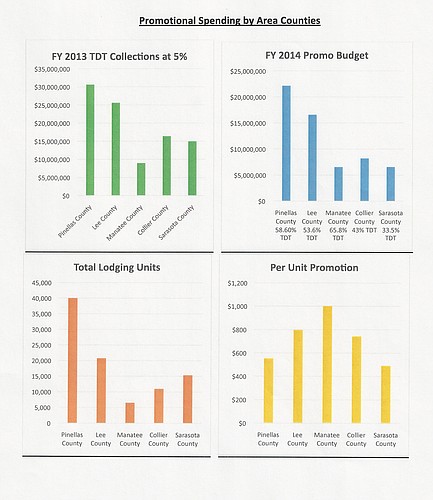

In one document tourist interests circulated, it shows how Sarasota County compares to its neighbors in spending tourist-tax dollars on marketing. Take a look at the three accompanying bar graphs. Sarasota County is clearly a laggard.

Even Collier County (Naples), the least populous of the counties and the one with the fewest hotel rooms, spends more on tourism promotion than does Sarasota County. When measured on promotional spending per hotel room, Sarasota County is last.

And to emphasize that last point, they will remind you that about 1,000 new hotel rooms are in the process of being constructed or about to be constructed in Sarasota County. Which means, without an increase in tourism marketing funds, Visit Sarasota County will be spending even less per hotel room to bring heads in beds.

That’s the marketing argument.

You need ‘things’

Then there is this side: You need “things” to keep the visitors coming. Great beaches are great. But in this competitive world — and it is indeed a competitive tourism world — you need more than sun and sand. You need other hard, attractive assets.

Which is why Commissioner Barbetta likes the Nashville model. If you re-allocate a portion of the tax to funding capital assets, you could leverage those funds with private developers. For example, $1 million earmarked in tourist taxes could be leveraged for $11 million in bonds to be repaid in 15 years, $17 million over 30 years.

To be sure, that kind of funding mechanism could provide the kind of boost Sarasota has needed for decades. How many times have various groups discussed the construction of a conference center or redoing Robarts Arena, only to go nowhere because of lack of financing?

If Greater Sarasota is indeed going to become the sports market (or mecca) that so many people think it can become, it’s going to need better facilities to do it. And those assets will always require cash — not just to build them, but also maintain them.

So you can see the validity of both arguments. To attract visitors to begin with, you have to have something they want to buy. But to get consumers to buy, you have to sell.

So then the questions become: Who should get what? How much should be spent on marketing? How much on beach maintenance? How much on the arts? How much on sports facilities?

Think of it holistically

As Sarasota County commissioners prepare to address the allocation of tourist taxes, they might consider re-framing the whole picture.

The way the tourist tax is divvied up now is the way governments always paint themselves into financial corners. They create trust funds and earmarked entitlements that lock spending into uses that often don’t make sense. Needs and demands change.

If you framed Sarasota tourism as a whole as a business — that is, the business of exporting our products and services to outsiders, or bringing in tourists to buy our goods and services, you would have a corporation whose executives and managers are charged with using the company’s assets and capital to generate a sustainable and attractive return on investment.

In other words, if operated like a business, you wouldn’t earmark year after year the same percentage of spending and investment in promotion, beach maintenance, the arts, etc., as is done now. The managers of the business would be charged with allocating and investing resources from year to year to generate the expected returns.

Take today. All of a sudden, sports are hot in this region. We have rowing, the pentathlon, IMG Academy, the Aquatic Center. Should more be invested in those facilities now at the expense of something else to ensure long-term returns?

Or, how about this: We need more airlines to use our airport. Would it be worth the ROI to use tourist-tax dollars to entice charter carriers — as was done successfully with USAirways many years ago in Philadelphia?

Moving in this direction would be far from the current thinking on how tourist-tax dollars should be allocated. But as long as county commissioners are about to change how they slice the tourist-tax pie, it never hurts to challenge the status quo.

Tourism is a business. Think of it holistically, not as separate fiefdoms or silos.

WHERE THE TOURIST TAX DOLLARS GO

Click here to view a table that shows how tourism marketing receives the largest individual share of the 5% bed tax imposed on hotel rooms and homes, condominiums, apartments and manufactured homes that are used for rentals.