- December 23, 2024

-

-

Loading

Loading

For a guy who graduated from Harvard and “taught” at the University of Chicago, Barack Obama sure didn’t “larn” much about economics or capitalism.

In fact, you could say he didn’t larn nuthin’.

President Obama, of course, continued his assault against liberty in favor of mandating material equality Tuesday night in his State of the Union address, Obama’s annual version of an “I Have a Dream” speech. This is his dream of taxing and confiscating every possible dollar out of successful Americans who legally, ethically and fairly earned their property.

Indeed, in spite of American voters telling him with bullhorns in November they don’t want his policies, he ticked off his list of proposed tax increases Tuesday night.

Seriously? Just as his economy is finally gaining traction, he wants to confiscate more of Americans’ property and redistribute more unearned benefits?

Give the guy an “F” in economics. As Steve Forbes tries to remind every politician who calls for tax increases, it’s pretty simple: When you raise the price, you get less of what you want. When you raise taxes, you get less economic growth, fewer jobs.

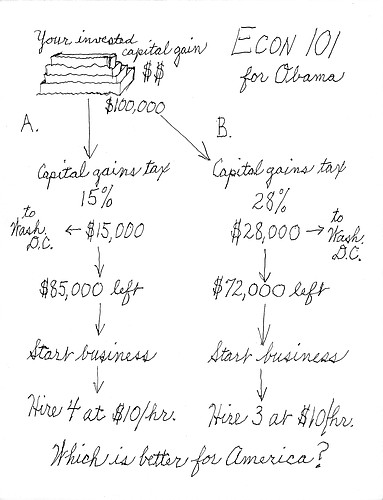

Maybe the president — and all of his fellow redistributionists — could understand a simple diagram of how economics, capitalism and human behavior works.

We chose to illustrate with the capital-gains tax because we figured even the University of Chicago and Harvard graduates could understand.

Of course, knowing what we know about President Obama’s understanding of economics, he likely would think in the example above that the additional $13,000 that goes to Washington with a 28% capital-gains tax would fuel economic growth. That’s money Washington would inject into the economy, so his thinking goes.

But let’s debunk that: In whose hands would that $13,000 be put to better use — say, Bill Gates, America’s great job creator, or Congress? Case closed.

What’s more, when capital gains are taxed at high rates, guess what? It stays locked up; investors don’t cash out; tax collections decline.

There is also this well-understood truism — well, understood by capitalists, anyway — that no matter how hard it tries, government does not create or produce wealth — ever. The late Milton Friedman, a University of Chicago graduate who actually learned something, explained that concept very clearly: “What government gives to one, it must take from another.”

In other words, raising tax rates — on capital gains, estates or corporate or personal incomes — will not produce economic growth or increased wealth.

But you can afford it, Obama says to those who have accumulated wealth and property (as a result of their hard work and ingenuity!).

Perhaps they can. But that’s not the point. Forcing them to pay higher taxes is the equivalent of theft, albeit legalized. It’s Obama wanting to use “the law” to force one American to serve another man’s (his) purpose. To take one man’s property and give it to another because this particular politician believes more in collective equality than he believes in individual liberty.

One more example: the corporate income tax. Obama and other altruist-equality-ites have no qualms about taxing corporate profits. But they refuse to accept another simple economic truism: Corporations do not pay taxes. They never pay taxes. They may physically send tax payments to the federal government.

But that tax money doesn’t come from the corporation. It comes from the corporation’s customers and consumers — in the form of higher prices.

Just imagine what would happen in the U.S. economy if the corporate income tax rate were cut in half. Think of all of the capital suddenly freed up to be invested in expanding successful businesses. Think how that would help the middle class.

It’s so simple. Econ 101.