- March 6, 2025

-

-

Loading

Loading

OK, sorry. We know all those numbers below will make your eyes glaze over. And they likely will make a lot of you go to the next page.

But don’t go yet. This is all about your tax money, all that sales tax you pay every time you make a purchase; the taxes you pay for cable TV and cellphone service; the gas tax at the pump; and those hefty doc stamps whenever you buy or sell real estate.

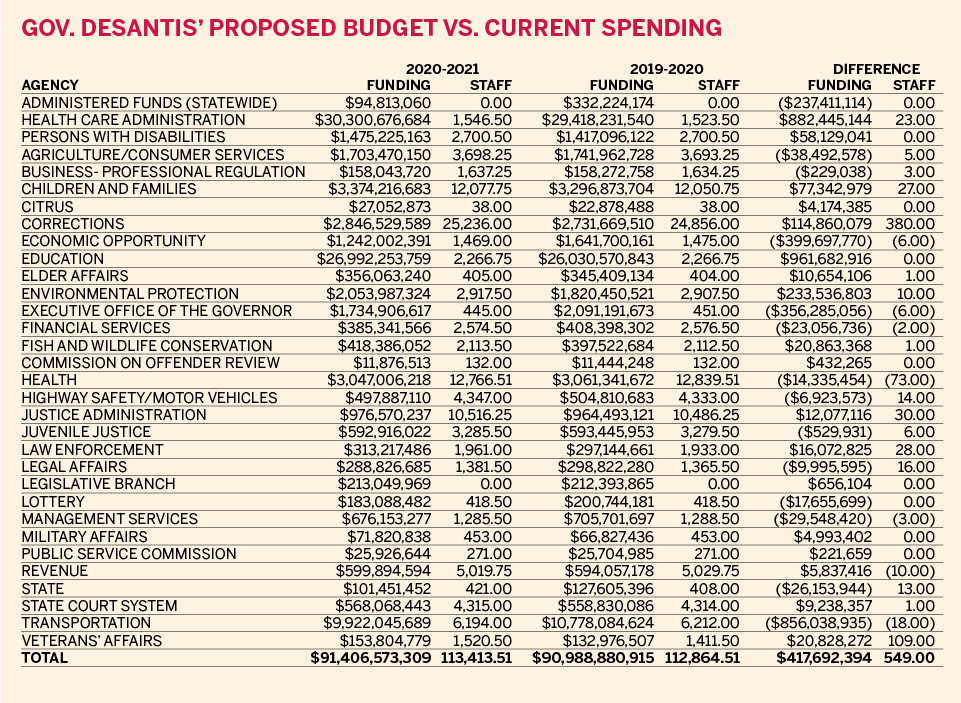

Where does all that tax money — all $91.4 billion of it — go?

Look below. That’s where.

At least that’s where and how Gov. Ron DeSantis would like to allocate that money. What you see is DeSantis’ proposed budget for the 2020 legislative session, which begins in January.

State lawmakers will move maybe a few hundred million or a billion here and there. But for the most part, not much — especially the total amount — will change in the state’s spending.

Indeed, one of facts few Floridians know is that most of their tax money goes to three categories. Nearly 90% of the state’s tax dollars, 88.4% to be exact, are spent on social services (48.1%), education (29.5%) and transportation (10.8%).

Within that group, the Agency for Health Care Administration consumes the largest amount — 33.1% of the state budget, or $30.3 billion. Of that, 96%, or $29.1 billion, goes toward Medicaid, the federal and state program that covers medical costs for low-income Floridians. Lawmakers often call Medicaid the Pac-Man that eats Florida’s budget. It grows every year.

That leaves $10.6 billion to fund everything else in 25 state agencies, 20 of which consume less than 1% of the budget.

Consider this: Keeping streets safe and fighting crime is always a priority in election campaigning. But law enforcement accounts for less than 0.5% of the budget.

If you think DeSantis is finally giving Florida’s environment its due by proposing to increase the Department of Environmental Protection’s budget nearly 13%, environmental protection still accounts for only for 2.2% of state spending.

No matter how much tax money flows into the state, for many special interests and citizens, it’s never enough. They point to the fact Florida ranks 40th in the nation in state and local taxes per capita.

But at the same time, does anyone really want to be taxed more? Every time you expand government, you reduce someone’s freedom.

To be sure, DeSantis will take his share of criticism for his proposed budget. He already has.

But given the obligations the state must fulfill with social services, education and other statutory mandates, DeSantis deserves credit. While proposing record increases for new teachers and an emphasis on the environment, his budget also fits within conservative norms. He is proposing only 0.4% increases in spending and the number of state employees.

In the larger context, this is why Florida’s economy continues to remain strong.