- April 11, 2025

-

-

Loading

Loading

OK, we know: All of these numbers are likely to make your eyes glaze over. We also know we are violating a rule of newspapering — overwhelming readers with too many numbers.

But all of these numbers are being printed with good intentions: to help Longboat Key taxpayers see how the Town Commission and administration plan to handle your tax dollars in the 2020 fiscal year.

This is budget time for every municipality, school board and county government throughout Florida. And it’s that time of year when taxpayers should raise their financial and tax antennae to keep watch over their local governments. Hopefully, the accompanying five tables and following text will help.

First, a summation: The Key’s financial condition is strong — as it usually is. The town has a long history of conservative fiscal management.

One indicator of that can be S&P Global Rating for the town’s outstanding general obligation bonds. Last year S&P raised the rating to AA+. Another is that the town has a rainy-day fund that can carry the town for six months of expenses. Town ordinances require only three.

Even with this financial strength, however, as a result of recent voter approvals, the town is embarking on major spending that will be adding $96.6 million in long-term debt for taxpayers to carry for the next 30 years.

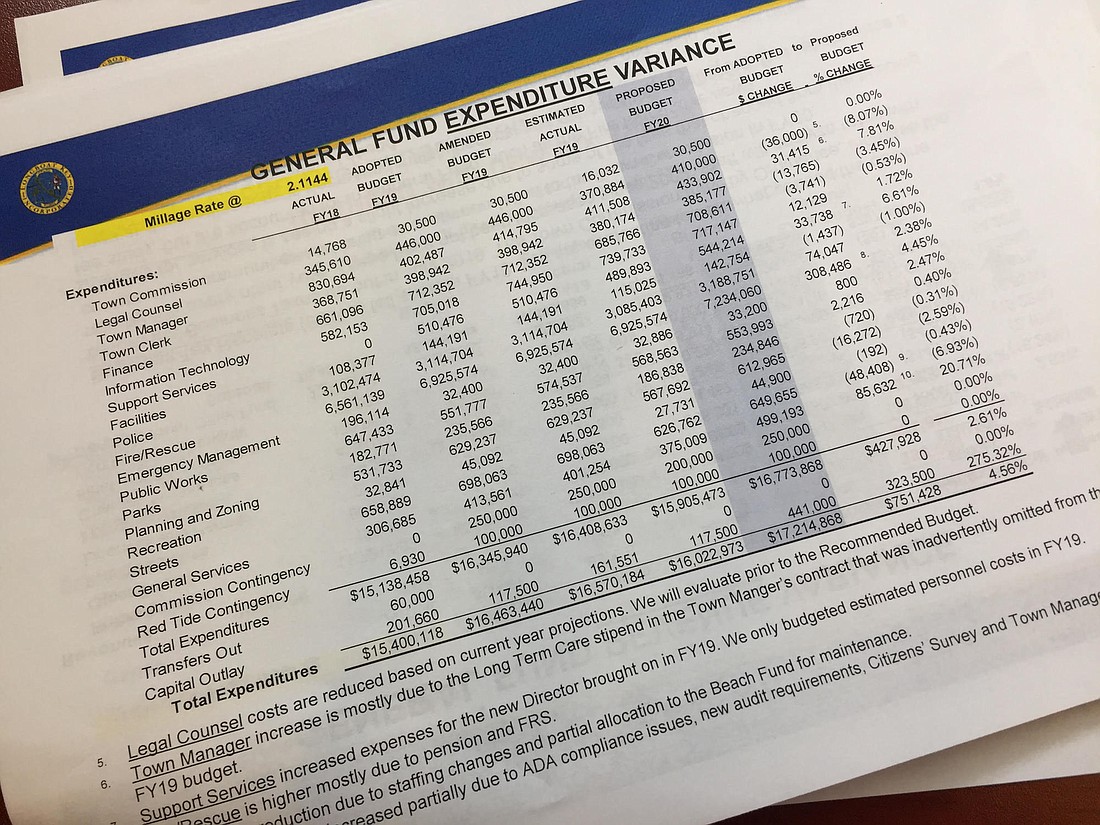

So let’s make note of each of the accompanying tables. (Note also we have bold-faced a few numbers that deserve attention):

1. General fund revenue and expenses: Operating expenses are expected to rise faster than revenues — never a good practice. Then add in the $323,500 increase in capital expenditures next year, and that will boost total spending 4.56%, which is well above inflation.

Capital costs will include painting Town Hall; replacing a generator and a roof; software and server replacements; $38,000 for Fire Department “bunker gear”; and a few other $25,000 to $36,000 equipment purchases. For the most part, these are one-time expenses and the cost of doing business.

2. Longboat’s taxable values: This 11-mile island continues to increase in value, with the Manatee County portion showing a 4.4% increase. For comparison: In 2018, the entire city of Sarasota had a taxable value of $9.66 billion. Longboat Key: $6.15 billion.

This high value gives town commissioners a lot of taxing and borrowing power.

3. Long-term debt: It’s rising quickly and in big amounts. And the table above is only part of the picture, as previously noted. Let’s not forget the town still has about $25 million in unfunded pension liabilities that are gradually being paid down.

This is more debt than the town has ever carried. Even so, the town is not in debt danger; it can always raise taxes.

4. Millage rates: The town administration is not proposing a tax increase on its basic operating millage. In fact, next fiscal year’s millage rates will be declining. Don’t forget, however, that taxpayers will be paying a special assessment for the underground utility project. And if voters approve a new beach bond next March, property taxes will go up in fiscal 2020-21.

5. Rainy-day fund: How much saving is too much? The town currently has twice as much set aside for emergencies as town law requires.

Although that can be seen as prudent, you also can make a case for returning, say, a quarter of the amount back to taxpayers or applying some of those funds to lower taxpayer debt.

After all, whose money is it?