- July 10, 2025

-

-

Loading

Loading

Even though millions of dollars might be an alarming amount of debt for one person, that amount is less concerning for a municipality.

It’s more about how the debt is managed over time that has a bigger impact, according to Finance Director Sue Smith and Town Manager Howard Tipton.

The pair said the town's goal is to keep debt steady and manageable from fiscal year to fiscal year.

In the upcoming fiscal year 2025, the town’s general obligation debt will shift slightly as some debt from the undergrounding project is paid off and additional debt is added for water and sewer projects.

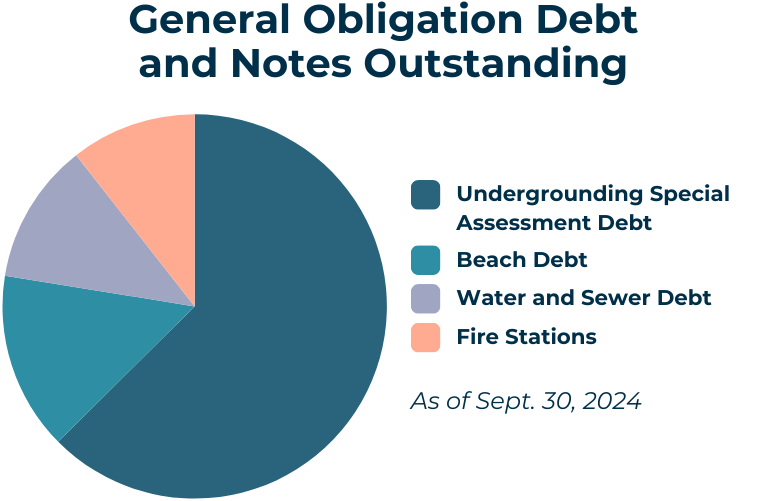

Overall, the town’s outstanding debt will total $47,491,545 as of Sept. 30, 2024.

About $29,713,725 of that debt is from the utility undergrounding project. That’s 62% of the town’s outstanding general obligation debt before FY25.

The undergrounding debt is a 30-year debt. The Gulf of Mexico Drive portion will mature in 2046, and the neighborhood undergrounding part will mature in 2048.

Next fiscal year, the town will pay back more of that debt. The project is expected to wrap up in December 2024 and is currently under budget by about $6 million. That will allow the town to pay off at least $6 million, but Smith said the payment could be as high as $12 million with redeemed bonds.

That benefits those residents who elected to make monthly payments for undergrounding, according to Smith. In November 2015, residents voted to allow the town to borrow up to $25.25 million for the Gulf of Mexico Drive portion of the undergrounding project.

Before the undergrounding project officially broke ground, property owners had to choose whether to pay their full amount owed in advance or elect to makre equal, annual payments for 30 years.

The town also has $7,117,367 in beach debt, which comes from beach nourishment projects. Once that debt is paid off, Smith said there will be two years where the town will not be required to make any payments.

But the town will continue to collect revenue from the millage to reduce the next amount borrowed. With rising costs, the extra collection will help Smith in her goal of borrowing the same amount for the 2020 nourishment for the major nourishment slated for FY29 — about $40 million.

The millage collected that goes toward the beach debt varies from Gulfside to Bayside. For Gulfside, the millage is expected to be 0.6116 in FY25, whereas the millage for Bayside will likely be 0.1529 in FY25.

That remains at about an 80/20 split since Gulfside residents benefit more from the beach.

When Smith says it’s important to keep debt steady between fiscal years, an example is with the fire station debt, which is currently at about $5,024,803. The fire station debt is paid back using the facilities bond mill rate, which was 0.0494 in FY24 and will be 0.0404 in FY25.

That debt was taken out to pay for the new fire facilities, but it was only taken out after town hall and the Public Works Department buildings underwent major renovations.

While there will be a significant decrease in what the town owes for undergrounding, the amount of debt for water and sewer projects will increase in FY25.

That debt, expected to be about $27 million, will add to the existing $5,635,651 for water and sewer. Certain projects are not optional and need to be started, Tipton said. In this case, it’s the asbestos pipe replacement in Country Club Shores and the subaqueous force main.

The subaqueous force main project, according to new estimates, is expected to cost around $30 million to replace the wastewater pipe from Longboat Key to the mainland, a small section of which burst in 2020 and caused a sewage leak.

Debt can also be used strategically, if managed responsibly, according to Tipton. In the case of the subaqueous force main, it doesn’t make sense to have everyone currently living on the island pay for the project upfront.

It’s also important to use the debt strategically and find the lowest rates, Tipton and Smith said.

Longboat Key is rated a double A-plus organization in a bond rating system that looks at current fund balances and revenue sources. The rating is basically the second highest and means the town is high-quality and has a low credit risk, Smith said.

Revenue bonds for utilities don’t usually require a referendum. But general obligation bonds require voter approval, which is what happened with the fire station debt.

The Town Commission will discuss this further at a special meeting on June 28.