- December 26, 2024

-

-

Loading

Loading

Facing an anticipated decline in fuel tax revenue, continually rising construction costs and antiquated impact fees on development, the city of Sarasota is considering increasing its impact fee structure to keep pace with the needs of the city’s growing population.

Redevelopment of land uses into higher density residential and commercial projects will continue to strain the city’s transportation infrastructure, and at an Aug. 12 workshop, city commissioners received a plan to raise the multimodal impact fees, which in part address congestion mitigation on city streets.

The basic impact fee formula is the cost to add capacity minus a credit for non-impact fee revenue from future development times demand generated by person-miles of travel.

At a cost of $5.8 million to add one lane mile of vehicle travel divided by its capacity of 13,400 vehicles per day, a person mile of travel is calculated at an infrastructure impact of $433. That equals a total impact cost of $14,700 for a single-family home per 2,000 square feet, for example, generating on average 34 person-miles of daily travel.

A person-mile is defined as the distance traveled by an individual regardless of the mode of transportation.

Spread across all forms of residential and commercial development, the industry standard formula calculates that one-time impact fee as $12,081, including credits, for a 2,000-square-foot single-family home, $8,654 per 1,300-square-foot low-rise multifamily unit, and per 1,000 square feet, fees are $5,287 for light industrial, $11,758 for office and $16,507 for retail.

Last updated in fiscal year 2016-17, Nilgun Kamp of Tampa-based traffic engineering consultant Benesch told commissioners the city’s impact fee structure isn’t nearly keeping pace with its population growth and correlating square footage expansion.

The city's current fees are $7,340 for a 2,000-square-foot single-family home, $4,738 per 1,300 square feet of low-rise multifamily, and per 1,000 square feet, fees are $4,657 for light industrial, $10,338 for office and $10,778 for retail.

Those deficits will be further exacerbated, Kamp said, by what is widely anticipated as a decline in the value of local fuel taxes hedged against inflation plus overall collections as fuel consumption declines in the future.

Multimodal impact fee revenue and expenditures | |||

| 2023 Actual | 2024 Estimate | 2025 Budgeted | |

| Beginning Fund Balance | $3,815,434 | $4,343,936 | $21,414 |

| Impact Fees | $679,111 | $600,000 | $600,000 |

| Available Balance | $4,629,995 | $4,943,936 | $621,414 |

| Expenditures | $286,059 | $4,922,522 | $180,324 |

| Ending Fund Balance | $4,343,936 | $21,414 | $441,900 |

“Even though transportation has a dedicated revenue source — fuel tax — as you know fuel taxes are charged on a per-gallon basis, and the state pennies are indexed, but local pennies are not allowed to be indexed,” Kamp said. “Over time, the value of the fuel tax is declining at the same time the costs are increasing, so we are seeing a bigger gap. A penny in the mid-’90s is now worth maybe its half its value between fuel efficiency and inability to index.”

Tax indexing is the adjusting of taxation rates in response to inflation.

All that is compounded by the anticipated decline in fuel tax revenues. The city’s proposed fiscal year 2025 budget warns that the historically slowly climbing local fuel tax revenue trend of the past decade — with the exception of 2021 in the height of the pandemic — is likely to backslide beyond next year.

“Gas tax revenue is going down due to several things. The impetus of electric vehicles is one, and fuel efficiencies,” Sarasota-Manatee Deputy Director and Planning Manager Ryan Brown told the Observer. “We're reliant on the fuel tax, and the federal fuel tax and state fuel tax have been held constant since 1993. Simple math shows you the revenues are going to be down. We’re approaching the cliff in terms of funding.”

10-year fuel tax revenue trend | |||

| Fiscal Year | 7-Cent Local Tax | 5-Cent Local Option | Total |

| 2016 | $1.52M | $0.97M | $2.49M |

| 2017 | $1.55M | $0.99M | $2.54M |

| 2018 | $1.63M | $1.03M | $2.66M |

| 2019 | $1.64M | $1.04M | $2.68M |

| 2020 | $1.53M | $0.95M | $2.48M |

| 2021 | $1.60M | $1.03M | $2.63M |

| 2022 | $1.65M | $1.01M | $2.66M |

| 2023 | $1.69M | $1.04M | $2.73M |

| 2024* | $1.65M | $1.05M | $2.70M |

| 2025* | $1.70M | $1.06M | $2.76M |

| *Projected | |||

That’s one reason a user-based tax on transportation system use is an idea being discussed at the state and federal levels. How that revenue would be distributed to the local level, if ever implemented, is unknown. If it ever were applied, “Even if you drive a Tesla, if you drive 10,000 miles a year, you’d be charged the flat rate,” Brown said.

Fuel taxes locally collected then distributed back to the city and county by the state have restricted uses, but the proposed fiscal year 2025 budget shows a transfer of $905,506 to the city’s general fund for transportation. As costs rise and revenue falls, the city will have to determine whether to cut funding for those other uses or trim that general fund transfer, a gap that could at least partially be filled by increasing the impact fees on development.

Impact fee revenue may not be used to address existing maintenance issues — repaving, replacing curb and gutter, etc. — only for expanding capacity. Capacity can also come in the form of funding for pedestrian trails, bike lanes, public transit and more.

That doesn’t necessarily mean adding asphalt. As Mayor Liz Alpert pointed out during the workshop, there aren’t many city-controlled streets that can be widened.

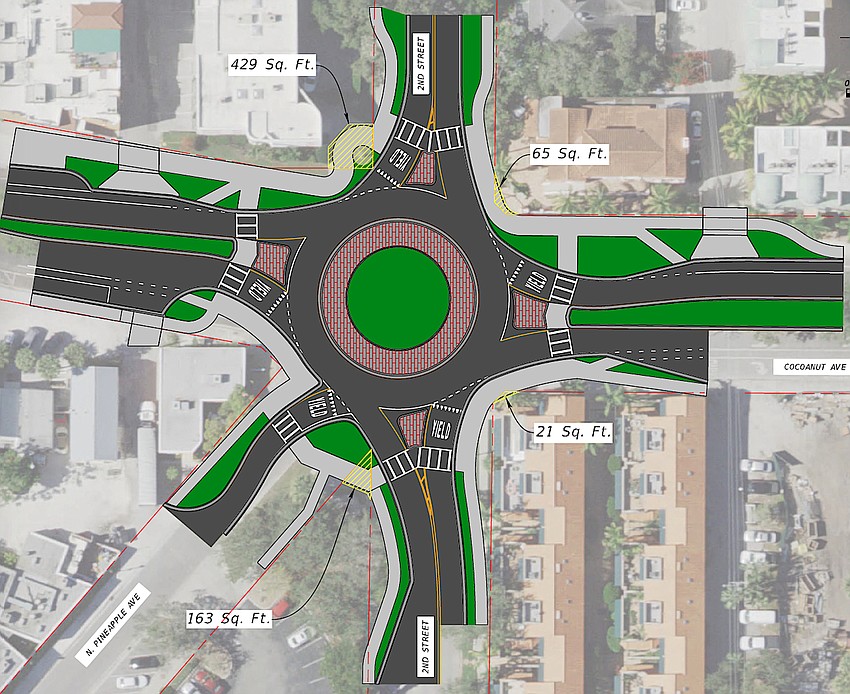

Eligible for impact fee funding is “any improvement that makes the flow of the traffic better and reduces congestion,” Kamp said. “Transportation capacity is measured in terms of speed of travel, so if you have an intersection that's having issues and there's an intersection improvement that alleviates that, that's improving the capacity. You may have a roundabout at a location that was gridlocked. That’s adding capacity.”

Because it was workshop, no action was taken on the matter, but an ordinance is expected to soon be brought before the City Commission for official consideration. The state requires a minimum of 90 days advance notice if the fees are to be increased.

“The tiered implementation of the revised fee schedule will be phased starting Jan. 1, 2025, allowing for gradual adjustment while meeting our infrastructure funding goals per state statutes,” said City Engineer Nik Patel. “This approach helps mitigate the impact on developers and community, promoting economic stability.”